5 hacks you must know to choose the best Personal Loan (without a salary transfer).

While the first and the best solution is always go for a Salary transfer loans, there are situations where in one might have to look at a Personal Loan which does not require a Salarty transfer. Some of the reasons might be.

1)A second loan while a Salary Transfer Loan is still being serviced.

2) Company is not listed for a Salary Transfer loan and hence non Salary transfer loan.

In this topic, let us understand the key elements which need to be considered while choosing a Personal Loan in UAE without a Salary Transfer requriement.

A Personal loan is an unsecured loan which simply means that the borrower is typically not required to provide any collateral for the amount that is being borrowed. These loans have the advantage of lesser paperwork involved and thus a lesser processing time. Though personal loans are easily available, they generally carry a higher ate of interest than a Salary Transfer Loan.

UAE banks offer personal loan facility to customers and the ease of availing such a loan can be as early as 2 hours to 5 working days from an application processing perspective.

So here are 5 hacks that you must know in order to choose the best personal loan.

-

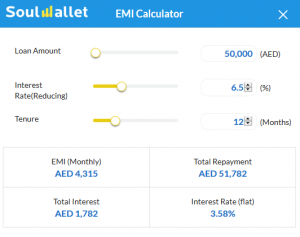

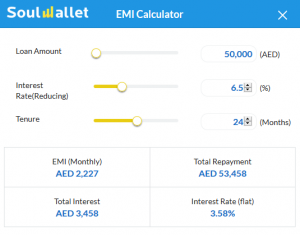

Right Tenure : It is important to choose a tenure of repayment that would be just fine considering your monthly budget. A longer period of repayment might mean lower EMI. At first sight, this might seem very tempting. But in reality, you might end up paying a lot more in the long run than you bargained for. Let’s say you apply for a loan for AED 50,000 at 6.5% interest rate for 1 year. The interest that you need to pay would be AED 1782, whereas it would be AED 3458 for a 2 year loan period. The difference between these two interests, which is AED 1676, is quite significant. Though the EMI might seem to be attractively lower for the 2-year period, the Interest paid might make you rethink your decision.

-

Borrow what you can repay: Some banks may offer you a loan amount that is more than what you require at the moment. This might be appealing as you might want to set aside this for some other expenses. But it is only advisable to borrow the amount that you might need. You might be also currently making payments towards other borrowed loans. In such a case, you should ensure that the total EMI outflow for all loans combined is not more than 50-60% of your total monthly income.

-

Charges – Know the costs: The interest rate charges should not be the sole factor while choosing between loans offered by multiple banks. Loan origination fees, application fees, late payment fees, fore closure fees and other charges should also be taken into account. For instance if you have excess funds with you and are considering a fore-closure, a bank which charges low or no penalty for the foreclosue would be beneficial. Processing fees is another charge that you should keep in mind ( usually at 2-3 %)

-

Credit Rating: A credit score, also known as the credit rating that is given by banks for your profile is based on the repayment history of loans previously taken, monthly income and other such factors. UAE uses Al Etihad Credit Bureau. You can get a copy of your credit report by visiting one of the Customer Happiness Centers by providing an Original Emirates ID card and passport copy. There is a nominal charge for the issuance of the report. For locations please visit Al Etihad Credit bureau website. Read our blogbuster “How to improve my credit rating”. The higher the score, the better the chances of the loan being sanctioned. The rate of interest and other charges also might vary depending on the score. It is thus critical that you keep a clean slate with no defaulted payments. You could also consider the credit history of a cosignee (such as your spouse’s) and jointly make an application for the loan. The Cosignee’s credit rating along with yours could improve chances of loan approval.

-

Making the right choice: It may not be wise to accept the first choice of loan that you come across. It is important to shop around and find the best one that suits your need before signing on the dotted line. Consider the Interest rates, Early settlement fee, Minimum monthly salary required and other such factors of each of the available choices of loans and then make a decision. A comparison simluator such as the one shown below enables you to view the attributes of loans across multiple banks side by side and could consequently help you make a better judgement.

Personal loan might be an appealing quick fix while you are in need of some immediate cash. Therefore, it is only advisable to be aware of all terms and conditions of the agreement and make wise decisions so as to not choose one which weighs heavy on your shoulders.

Plz give me loan

Dear Munir, Thanks for your comment. Please share your contact number on email to support@soulwallet.com and we will have a specialist call you. In the meanwhile, we strongly urge that you visit our loans page and chek out the product details. https://www.soulwallet.com/personal-loans. Thanks